REAL ESTATE TIPS AND RECOMMENDATIONS

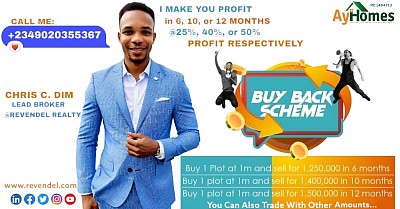

Real Estate Buy-Back Investment Proposal

AyHomes Investment Limited is proud to reintroduce our highly successful real estate investment opportunity: the Sabi Volume 1 Buy-Back Scheme. This scheme offers investors the chance to earn returns of up to 50% on their real estate investments within a year.

Business Opportunity

Invest in our prime real estate properties and benefit from a structured buy-back scheme. Whether you are looking for short-term gains or long-term growth, Sabi Volume 1 offers lucrative returns, supported by secure documentation. We present to you our Buy-Back scheme with which you can trade Real Estate (lands) for 6 months to 12 months for profit making. This product has been on the market for over 8 years and is still counting.

Solution

Investors purchase plots in our estates at ₦1,000,000 per plot and sell them back to AyHomes after 6 to 12 months with significant returns. This is a low-risk investment backed by post-dated checks and other legal agreements.

Return on Investment (ROI) Highlights

- 20% return on investment for 1 to 14 plots in 6 months.

- 25% return on investment for 15 plots or more in 6 months.

- 50% return on investment for all plots in 12 months.

Sabi Volume 1 offers a unique and profitable investment opportunity in the real estate sector. With guaranteed returns, legal backing, and flexible investment options, AyHomes Investment Limited provides a secure avenue for investors to grow their wealth.

Documents You'll Get:

Post-Dated Cheque

Deed for Land Purchase/Buy-Back

Acknowledgment Letter

Payment Receipt

Don't miss out! Invest now and multiply your financial wealth with AyHomes Investment Limited. Let us be your organization’s wealth building partner. Kindly reach out for presentation both online and/or offline. +2349020355367; contact@revendel.com

How Not To Be A Victim Of Lagos Demolitions: Requirements

It is often said that wise people learn from the mistakes of others. You don't need to see your years of labour brought down to rubbles in minutes. This piece may be addressing both present and future Lagos State real estate investors whether individual or corporate entities. Other states in the federation may have similar or different requirements.

Government Accountability in Building Construction: The Essential Steps and Documentation.

In Lagos, the process of constructing a building is governed by a series of stringent regulations and requirements. However, there have been numerous instances where government approvals have been granted erroneously or fraudulently. This has led to inadequate monitoring and supervision of construction projects, contributing to the city's recurring flood issues. The government must acknowledge its role in these illegal approvals and recognize its liability in the resulting environmental disasters. The innocent victims of these demolitions must be compensated adequately and transparently to boost investors confidence. No government can afford to fraudulently issue title documents and approvals and later go about destroying same approved investments without a well streamlined compensation plan. One of the obvious consequences of such negative move is serious investors avoiding your territory.

Steps to Construct a Building in Lagos:

1. Preparation of All Required Documents:

- Survey plan

- Title documents

- Architectural, structural, mechanical, and electrical plans

- Soil investigation and report

2. Submission and Review by LASPPA:

The Lagos State Physical Planning Permit Authority (LASPPA) reviews all submitted documents to ensure compliance with regulatory standards.

3. Approval and Permit Issuance:

Once reviewed, LASPPA grants the necessary approvals and issues construction permits.

4. Commencement of Construction:

With the permits in hand, construction can commence under the guidelines provided.

5. Final Inspections and Compliance Checks by LASBCA:

The Lagos State Building Control Agency (LASBCA) conducts final inspections to ensure the building complies with all safety and regulatory standards before it can be occupied.

Mandatory Documents and Reports:

1. Survey Plan:

An accurate depiction of the land area for the proposed building.

2. Architectural Drawings:

These must be sealed, signed, and stamped by an architect registered with the Architects Registration Council of Nigeria (ARCON).

3. Tax Clearance Certificate:

Proof that the builder has met all tax obligations.

4. Land Use Charge Receipt:

Confirmation of payment for land use charges.

5. Proof of Ownership:

Legal documentation proving ownership of the land.

6. Structural Drawings:

Detailed designs illustrating the structural integrity of the building.

7. Structural Stability Letter:

A letter verifying the stability of the structure.

8. Structural Engineer's Supervision Letter:

A commitment from a registered structural engineer to oversee the construction.

9. COREN Calculation Sheets:

Calculations from the Council for the Regulation of Engineering in Nigeria (COREN) to ensure engineering standards are met.

10. Subsoil Investigation Report:

A report on the soil conditions at the construction site.

11. Electrical Drawings:

Detailed plans for the building's electrical systems.

12. Mechanical Drawings:

Plans for the mechanical systems within the building.

All these requirements varies from state to state including the Federal Capital Territory. It is the ultimate responsibility and interest of the real estate investor or developer (individual/corporate) to ensure that all regulatory requirements of their respective investment destination are met to the later.

The fact remains that Nigerians cannot afford to continue doing things anyhow and expect the country to compete with other parts of the world in terms of infrastructural development.

And most importantly, the government's complicity in fraudulent approvals and inadequate monitoring must be addressed. By holding responsible parties accountable, we can mitigate the adverse effects of such negligence and ensure safer, more resilient infrastructure for the future.

To see other highly informative piece on real estate, visit https://www.revendel.com/blog.html. And for your real estate investment enquiries, call or WhatsApp: +2349065211138; Email: contact@revendel.com.

The Airbnb Effect: How Short-Term Rentals Are Transforming Real Estate.

The rise of short-term rentals, epitomized by platforms like Airbnb, has revolutionized the real estate landscape. What was once a niche market has now become a global phenomenon, fundamentally altering the way people travel and invest in real estate. In this piece, we will explore the Airbnb effect and how short-term rentals are transforming the real estate industry.

1. The Airbnb Phenomenon

Airbnb, founded in 2008, pioneered the concept of allowing homeowners to rent out their properties to travelers on a short-term basis. This innovative platform quickly gained popularity, challenging the dominance of traditional hotels and motels. Today, Airbnb boasts millions of listings worldwide, making it a formidable player in the hospitality industry.

2. The Appeal of Short-Term Rentals

Short-term rentals offer several advantages that have contributed to their widespread adoption:

- Flexibility: Travelers can choose from a wide range of unique accommodations, from cozy apartments to luxurious villas.

- Local Experience: Short-term rentals often provide a more authentic experience, allowing guests to immerse themselves in local culture.

- Income Generation: For property owners, short-term rentals can be a lucrative source of income, often outperforming traditional long-term leasing.

3. Impact on Real Estate Markets

The Airbnb effect has had a profound impact on real estate markets worldwide:

- Higher Property Values: Short-term rentals can increase property values in tourist-heavy areas, attracting investors looking for higher returns.

- Increased Demand: The demand for properties suitable for short-term rentals has surged, driving up prices in popular vacation destinations.

- Regulatory Challenges: Many countries and/or cities have introduced regulations to address concerns such as housing shortages and neighborhood disruptions caused by short-term rentals.

4. Investment Opportunities

Short-term rentals have opened up new investment opportunities:

- Real Estate Investors: Investors have started purchasing properties specifically for short-term rentals especially in cities like Lagos, Abuja, PortHarcourt, etc, aiming for higher rental income than traditional leases.

- Property Management Services: Companies specializing in property management for short-term rentals have emerged, offering homeowners hassle-free rental experiences.

5. Challenges and Considerations

While short-term rentals offer many benefits, there are challenges and considerations for both hosts and travelers:

- Regulatory Compliance: Hosts must navigate local regulations, including taxation and zoning laws in some countries.

- Operational Commitment: Managing short-term rentals requires time and effort, from guest check-ins to general property maintenance.

- Market Saturation: In some areas, market saturation can lead to increased competition and lower occupancy rates.

6. Future Trends

The future of short-term rentals continues to evolve:

- Sustainability: Travelers are increasingly seeking eco-friendly accommodations, driving the demand for sustainable short-term rentals.

- Technology Integration: Smart home technology is becoming more common in short-term rentals, enhancing guest experiences.

- Hybrid Models: Some hosts are adopting hybrid models, offering both short-term and long-term rentals to maximize income.

In summary, the Airbnb effect has undeniably transformed the real estate industry, impacting property values, investment strategies, and travel experiences. As short-term rentals continue to evolve and adapt to changing market dynamics, they will likely remain a significant force in the world of real estate. Whether you're a traveler seeking unique lodging or an investor exploring new opportunities, the Airbnb effect has left an indelible mark on how we view and engage with real estate.

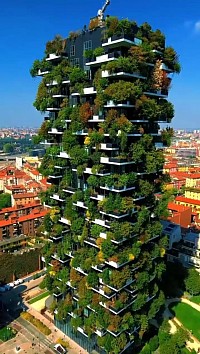

Green Real Estate: Sustainable Homes for a Sustainable Future

The global shift toward sustainability has transformed various industries, and real estate is no exception. As concerns about climate change and environmental impact continue to rise, the concept of green real estate, which focuses on building and promoting sustainable homes, has gained significant traction. In this comprehensive article, we will explore the growing importance of green real estate, its benefits, and how it is shaping the future of the housing market.

1. Defining Green Real Estate

Green real estate, also known as sustainable or eco-friendly real estate, refers to properties that prioritize environmental responsibility and energy efficiency. These homes are designed, built, and operated to minimize their impact on the environment while maximizing the comfort and well-being of their inhabitants.

2. The Benefits of Green Homes

Green homes offer a multitude of advantages for both homeowners and the planet:

- Reduced Environmental Footprint: Sustainable homes use fewer resources, produce less waste, and consume less energy, reducing their carbon footprint.

- Energy Efficiency: Green homes often feature advanced insulation, efficient heating and cooling systems, and solar panels, resulting in lower utility bills.

- Improved Indoor Air Quality: Sustainable materials and ventilation systems ensure cleaner, healthier indoor air for residents.

- Increased Property Value: Green homes tend to have higher resale values and may qualify for energy efficiency incentives and tax credits.

- Long-Term Savings: Although green construction may involve higher initial costs, homeowners typically recoup these expenses through lower utility bills and reduced maintenance.

3. Key Features of Green Homes

Green real estate focuses on several key features that enhance sustainability:

- Energy-Efficient Appliances: Homes are equipped with appliances that meet stringent energy efficiency standards.

- Solar Power: Solar panels or solar water heaters harness renewable energy sources, reducing reliance on fossil fuels.

- Passive Solar Design: Homes are designed to maximize natural heating and cooling through strategic window placement and insulation.

- High-Performance Insulation: Enhanced insulation materials reduce heating and cooling energy requirements.

- Water Efficiency: Low-flow plumbing fixtures and rainwater harvesting systems conserve water resources.

4. Certifications and Standards

Various certifications and standards help identify green real estate:

- LEED (Leadership in Energy and Environmental Design): LEED certification is a globally recognized standard for green building design and construction.

- Energy Star: This program certifies homes for energy efficiency, including heating, cooling, and water heating.

- Passive House: Passive House standards focus on ultra-energy-efficient design and construction, achieving unparalleled energy savings.

5. The Impact on the Real Estate Market

Green real estate is shaping the future of the housing market:

- Growing Demand: Homebuyers increasingly prioritize sustainable features when searching for properties.

- Market Value: Green homes command higher market values and may sell more quickly.

- Regulatory Changes: Governments are implementing stricter building codes and energy efficiency requirements, pushing the market toward greener practices.

6. Challenges and Considerations

While green real estate offers many benefits, challenges include:

- Initial Costs: Green construction can be more expensive, although long-term savings offset these costs.

- Limited Availability: Green homes may not be readily available in all areas, limiting choices for buyers.

- Consumer Education: Buyers may need to be educated about the benefits and costs associated with green homes.

Conclusion

Green real estate represents not only a sustainable choice for homeowners but also a critical step toward addressing our environmental challenges. As the world becomes more environmentally conscious, green homes are poised to become the norm rather than the exception in the real estate market. They offer a sustainable future for homeowners, a reduced carbon footprint for the planet, and a clear path towards more responsible construction practices. Investing in green real estate today not only benefits homeowners but also contributes to a sustainable and prosperous future for all. Visit our other articles for more insights.

Chris C. Dim is the Lead Broker @ Revendel Realty. Asynchronous communications can be furthered on WhatsApp for property investment inquiries. Email: contact@revendel.com.

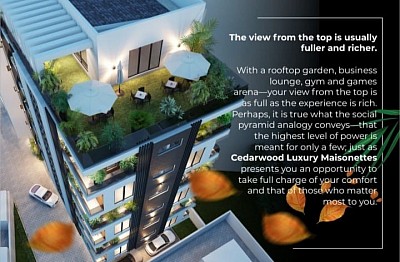

AyHomes Buy-Back Scheme: A Lucrative Real Estate Investment Opportunity.

Real estate investment has always been a reliable avenue for financial growth, but the Ayhomes Buy-Back Scheme takes it to the next level. Ayhomes, a reputable real estate company, has introduced an innovative investment model that offers guaranteed returns on investment (ROI) within specific timeframes. This scheme allows clients to invest in plots from Sentosa City Phase 2 at a reduced price and then reap the rewards after a predetermined period.

Ayhomes Buy-Back Scheme in Detail:

The Ayhomes Buy-Back Scheme is designed to provide investors with attractive returns, offering three different investment durations, each with its corresponding profit margin:

1. Six-Month Investment:

- Purchase a plot for 1 million.

- Sell it back to Ayhomes after 6 months for N1.250 million, securing a 25% profit.

2. Ten-Month Investment:

- Invest in a plot for 1 million.

- Ayhomes buys it back from you after 10 months for N1.400 million, resulting in a 40% profit.

3. Twelve-Month Investment:

- Acquire a plot for 1 million.

- Ayhomes repurchases it from you after 12 months for N1.500 million, yielding a 50% profit.

Note: There's no limit to how much you can invest.

Investor Benefits:

1. Guaranteed ROI: The Ayhomes Buy-Back Scheme provides investors with a secure and guaranteed return on their investment. Regardless of market fluctuations, clients can count on their predetermined profits.

2. Reduced Entry Price: Clients can enter the real estate market with a lower initial investment compared to traditional real estate purchases. This makes it accessible to a broader range of investors.

3. No Hidden Charges: Apart from the investment sum, investors will not pay any extra charges for documentation or deal execution.

4. Legal Safeguards: Investors receive a Deed of Buy-Back Scheme/Contract, A Post-Dated Cheque, A Receipt, and An Acknowledgment Letter.

These documents ensure the LEGALITY and TRANSPARENCY of the investment.

5. Flexibility: Ayhomes understands that some investors may require access to their profits sooner. Therefore, clients have the option to receive 50% of their expected profit upfront just six weeks after making their investment.

6. Mouth Watering Incentives: Please check for the full list in the comment section.

7. No Agency Fee: Investors will not pay any agency fee to Revendel Realty for deal execution. The only money you're committing to the deal is the investment capital. Nothing more.

Why Choose Ayhomes Buy-Back Scheme:

1. Proven Track Record: Ayhomes has a strong reputation in the real estate industry, with a history of successful projects and satisfied customers.

2. Risk Mitigation: The Buy-Back Scheme minimizes the risk associated with real estate investments by guaranteeing profits.

3. Diverse Investment Options: Clients can choose the investment duration that aligns with their financial goals and risk tolerance.

Ayhomes operates with transparency and integrity, ensuring that clients' investments are secure and their interests are protected.

Conclusion:

The Ayhomes Buy-Back Scheme is a groundbreaking real estate investment model that empowers individuals to enter the real estate market with confidence. By offering guaranteed returns, reduced entry costs, and legal safeguards, Ayhomes is revolutionizing the way people invest in real estate. Whether you're looking for a short-term or long-term investment, Ayhomes has an option tailored to your needs, all while ensuring a secure and profitable venture in the thriving real estate sector. Invest with Ayhomes today and watch your financial future prosper.

We are available 24/7 to answer all your questions and help you get started.

Real Estate: Where Dreams Meet Determination and Investments Turn into Legacies

Introduction

In the world of investments, few opportunities hold the promise of real estate. It's a realm where dreams take shape and determination drives success, ultimately transforming investments into lasting legacies. Real estate is more than bricks and mortar; it's a canvas for stories, a playground for ambitions, and a foundation for financial stability. Let's take a look at the following points.

The Dreamer's Haven

Real estate begins with a dream. It's the vision of a young couple searching for their first home, the entrepreneur imagining their business's headquarters, or the aspiring landlord envisioning passive income streams. These dreams fuel the real estate market, shaping cities and landscapes in the process.

Owning a piece of property isn't just about having a roof over your head; it's about realizing your aspirations. It's the feeling of walking into a house for the first time and seeing your future unfold before your eyes. It's the joy of watching a barren plot of land transform into a thriving garden, reflecting your hard work and dedication. Real estate serves as a bridge between dreams and reality, connecting people with their deepest desires.

The Determined Investor

Success in real estate doesn't come easily. It's a world where determination is the currency of choice. The determined investor understands that it takes more than just capital to thrive in this market. It requires meticulous research, strategic planning, and a willingness to adapt.

Navigating the complexities of real estate demands dedication and patience. Investors must keep a keen eye on market trends, stay up-to-date with local regulations, and be prepared to weather the storms of economic downturns. The determined investor knows that every setback is an opportunity to learn and grow, and they persevere with unwavering resolve.

Investments That Transcend Generations

Real estate is not just about making money today; it's about building a legacy for tomorrow. Unlike other investment avenues that may be fleeting, properties have a timeless quality. They can be passed down from one generation to the next, becoming a source of pride, stability, and wealth for entire families.

Investing in real estate can create a lasting impact on your family's financial future. It provides a sense of security, knowing that you have tangible assets that can weather economic fluctuations. These properties can also serve as a source of income, offering financial support and opportunities for future generations.

The Power of Diversification

One of the most significant advantages of real estate is its role in diversifying an investment portfolio. While stocks and bonds can be volatile, real estate often acts as a stabilizing force. It can offset risks associated with other investments, providing a cushion during market downturns.

Diversifying with real estate can also bring you into different markets, both geographically and in terms of property types. From residential homes to commercial spaces, industrial warehouses to vacation rentals, the real estate market offers a wide array of options to suit your investment goals and risk tolerance.

Conclusion

Real estate is where dreams come to life, where determination paves the path to success, and where investments can become enduring legacies. Whether you're a first-time homebuyer, a seasoned investor, or a family looking to secure its financial future, real estate offers a world of opportunities.

So, the next time you walk through the doors of your home or stand on a plot of land you've invested in, remember that you're not just buying property; you're investing in your dreams, your determination, and your legacy. Real estate is more than an asset; it's a testament to the power of human ambition and the potential for lasting prosperity.

Our Team will help you navigate through your investment journey successfully. Speak with us today.

There Is More Money And Less Risk In Real Estate - Series 7: Embrace Real Estate Golden Strategy [Land Flipping]

You must have heard that lots of the world’s billionaires made their fortune in the real estate business. Yet, quite a lot of real estate investors have not embraced the golden strategy that has helped billionaire real estate moguls enjoy up to 300% return on investment (ROI) within short periods.

In this series, you will have the opportunity to understand the power of land flipping. Do you want to make it big-time in the property market? Then you must embrace land filliping, the winning strategy employed by real estate moguls who make stupendous profits in the real estate business.

Definition of land flipping

Land flipping is a real estate practice where a property investor purchases land from a seller at a low price and then resells at a later date, for a profit. It takes an investor with foresight and patience to reap maximum profit by flipping land.

A wise land flipper often buys land in a remote location that has the potential for fast development, knowing that someday, someone will be interested in buying the property at a higher cost. Sometimes, the land flipper improves the value of the land by fencing it and then makes a huge profit on the investment. At other times, he or she leaves the land fallow, incurring less than an infinitesimal maintenance cost. At the end of the day, the value would be appreciated; and he or she can resell to make a profit.

For instance, you may have bought a plot of land in a faraway neighbourhood, state, or country, at N800,000. Five years later, you resell the same piece of land for N8 million. That’s land flipping at work. You can also buy four plots at N800,000. After its value has appreciated to N2 million per plot, you can sell three plots at the prevailing price and use the proceeds to build on the remaining plot. This is another flipping process that guarantees a stupendous return on investment.

Now, land flipping is an incredible form of profit-taking. Central to its profitability is the fact that the value of land does not dawdle over time as is the case with stocks or other forms of investments. Depending on location, the value of land can rise up to 30% in one year. Land in places like the Lekki Phase 1 axis of Lagos State has recorded a 500% value appreciation in just five years.

Attractions to land flipping

As earlier hinted, investment in land requires minimal maintenance, unlike investment in buildings which would need renovation from time to time. So, it is an ideal business for people with low start-up capital. Invariably, investment in land is easier to manage. A look at the downsides of other forms of real estate investment will reveal all sorts of stress such as problems associated with maintaining relationships with tenants, government, and maintaining integrity as a house owner or landlord. Land flipping eliminates all of these worries.

There is also ease of selling. Just buy land in a fast-developing area and wait for prospective buyers. You do not necessarily need a professional realtor or agent or much advertisement before you can sell your land.

The competition found in other levels of the real estate industry is usually absent in land-flipping deals. So, after you have determined your most advantageous location and have bought your land from the right owners, you can then make your cool profit; leveraging on the fact that people generally procrastinate over stuff like investing in remote places.

Be a smart land flipper by demonstrating the ability to identify potential highly viable areas and buying while the price is relatively low.

Keep it fraud-free

I am sure that by now, you are feeling a strong pull to explore the opportunity that land flipping offers. But I must warn you to be careful not to be caught in the web of fraudsters.

There are cases of people who collude and form a group who buy land at a low price. They fraudulently balloon the cost of the land above its actual value by selling the property to themselves, one after the other.

When a land flipper engages in such manipulation of the market value of a property and then sells the land to an unsuspecting outsider at an inflated cost, that unwholesome behaviour makes the land flipper fraudulent.

In most cases, such sharp practices can be used for various issues such as hidden legal issues, toxic pollutants, liens, or easements.

For instance, a land-flipping group of six people purchases land at N500,000. Each member of the group sells the piece of land for a slightly higher price. After the sixth person buys the land, the land is then sold to an outsider for N5,500, 000; fraudulently implying that the value of the land has risen by N5,000,000.

Now, this has special implications for financial institutions, who face the risk of a land flip when making loans for the purchase of undeveloped property. In a situation where the lender may have to repossess the property if a buyer defaults in payment, it may be difficult to resell the property, even at a break-even price.

Nothing better than land-flipping

Ideally, flipping land is one of the best ways of making money in real estate. Many either overlook the flipping of vacant land or misunderstand it. But it remains a very simple concept. In the land business, one is either buying or selling.

Conclusion

When you are buying a property, there are 5 steps you have to consider: You have to do your market research; you find motivated sellers to do the marketing; there is lead processing, due diligence, and closing the deal. But where you find yourself as the seller of a property, there are only three steps to consider. The first is marketing to find buyers; next is lead processing – seller financing management, and the third is closing the deal. The fourth is optional, applying your discretion based on the nature of the offer on the table or present circumstances.

There Is More Money And Less Risk In Real Estate - Series 6: Carrying Out Real Estate Due Diligence

If you must succeed in real estate, particularly in Nigeria, then you must learn to come to terms with the fact that there are many practices in the sector that are not taught in our universities and polytechnics; not even in Lagos Business School.

Yes, formal education will teach you how to buy land and how land measurements are done, but it will not teach you how to deal with land-owning families (Omoniles) or how to come out of land dispùtes and other pitfalls dotting the Nigerian real estate industry.

Real estate transactions are fraught with problems. To succeed as a realtor, you must have the heart to deal with these problems when they come your way. That is why performing your due diligence before any property is bought must be considered a critical factor in property transactions.

There have been reported cases of many investors who have lost huge sums of money while investing in property in Nigeria and abroad.

Recently, cybercriminals have been targeting home buyers and renters and, as a result, experts have been advising real estate practitioners and unsuspecting property investors to carry out due diligence before buying properties. A wise realtor or investor should not let his or her guard down. If you do your due diligence, you will lose less than the next person.

The first step in getting your dealings with Omoniles, especially in land transactions, is never to take the word of any of the landowners as final. Check it out so that you don’t buy land that is subject to litigation or marked for demolition by the government. You’ve to be intentional about investing in real estate. You need courage in the face of challenges.

Assume the responsibility that you have a role to play in curtailing the prevailing incidents of prospective property, and land buyers being duped of their hard-earned money. Always have at the back of your mind that the lack of due diligence investigations prior to paying for the envisaged property or parcel of land gives criminals and quacks in the profession higher chances of perpetuating their evil enterprise.

A study has shown that many survey plans, deeds of assignment, certificates of occupancy, government allocation letters, and government gazettes paraded by fraudulent property sellers are forged. It takes expertise and thorough investigations to figure out stuff like this.

Nasty tales of people falling prey to the whims and caprices of desperate and unscrupulous so-called land sellers, omoniles, and quack surveyors are rather too numerous in Nigeria.

Therefore, it is advisable that prospective land buyers, in their own interest, stringently investigate the genuineness, validity, or otherwise of a property before parting with their money.

Simple method of conducting due diligence checks

A survey search on a property will reveal whether, for instance, that area has been designated for any specific purpose in the near future by the government. For instance, a piece of land mapped out for agricultural purposes is definitely a no-go area if you look forward to building a residential apartment. You will have yourself to blame if you unwittingly purchase any of the so-called "committed lands or government acquisition." It takes a good surveyor to ascertain the precise coordinates of a piece of property and to figure out whether a land gazette or any other document is fake or not.

It also goes without saying that you need the services of a qualified and street-smart property solicitor, a surveyor, or any other expert well knowledgeable about land matters to guide and help you in ascertaining the genuineness or otherwise of that property.

So, before you pay for a property, it is advisable you collect, if possible, photocopies of the property's survey plan, deed of assignment, and certificate of occupancy from the person who wants to sell the property to you, pass them to your solicitor, surveyor or a professional. They will in turn use the information to do a property search at the land bureau or land registry.

If for any reason, a prospective property seller refuses to release

photocopies of the said property's documents to you for investigation prior to payment, you don't need a soothsayer to tell you that something is wrong with such property somewhere.

Conclusion

It is also expected for instance that the proposed Geographic Information System (GIS) by the Lagos State government and other state governments' relevant laws will put an end to sharp practices by fake property agents. My honest counsel is to part with little professional fees than to ignorantly part with the money you will pay for an unverified piece of real estate and then regret it later.

Never forget to investigate before you take the plunge.

Exploring the World of Real Estate Trading: A Lucrative Investment Opportunity

Introduction:

In today's ever-evolving financial landscape, real estate trading has emerged as a highly lucrative investment avenue for individuals seeking to diversify their portfolios and generate substantial returns. Real estate trading involves buying and selling properties with the aim of capitalizing on market fluctuations, maximizing profits, and leveraging real estate assets to create wealth. This article delves into the intricacies of real estate trading, highlighting its benefits, strategies, and potential risks.

Understanding Real Estate Trading:

Real estate trading, also known as real estate flipping or house flipping, refers to the practice of purchasing undervalued properties, renovating or improving them, and selling them at a higher price within a relatively short period. The primary goal is to capitalize on the appreciation of property values or create value through strategic renovations and improvements. Real estate traders are adept at identifying properties with unrealized potential and utilizing their knowledge of market trends to execute profitable transactions.

Benefits of Real Estate Trading:

Potential for High Returns: Successful real estate trading can yield substantial profits in a relatively short period. By buying properties at discounted prices, adding value through renovations, and selling at market value or higher, traders can earn significant returns on their investments.

Diversification: Real estate trading offers an excellent opportunity to diversify investment portfolios beyond traditional stocks and bonds. Adding real estate assets to a well-rounded portfolio can help spread risks and provide a hedge against market volatility.

Tangible Assets: Unlike some investments that exist only on paper, real estate trading involves tangible assets in the form of properties. These physical assets provide a sense of security and can be leveraged to generate additional income through rental properties.

Strategies for Successful Real Estate Trading:

Market Research and Analysis: Thoroughly researching local real estate markets is crucial for identifying properties with potential for value appreciation. Analyzing historical sales data, studying neighborhood trends, and staying updated on economic factors impacting the market are essential for making informed investment decisions.

Financial Planning and Budgeting: Real estate traders must establish a comprehensive financial plan, including budgeting for acquisition costs, renovations, carrying costs (such as property taxes and insurance), and potential contingencies. This planning ensures better control over finances and minimizes the risk of unexpected expenses.

Renovation and Property Enhancement: Enhancing the value of a property through strategic renovations and improvements is a key aspect of real estate trading. Investing in upgrades that align with market demand and yield a significant return on investment is crucial for maximizing profits.

Timing and Exit Strategy: Successful traders understand the importance of timing their transactions. Monitoring market conditions and selling properties at the right time can make a substantial difference in profitability. Developing a clear exit strategy and sticking to it helps mitigate risks and avoid prolonged holding periods.

Risks and Challenges:

Market Volatility: Real estate markets are subject to fluctuations and can be influenced by various economic factors. Market downturns can impact property values and potentially lead to losses if not carefully navigated.

Financing and Cash Flow Management: Securing financing for real estate trading can be challenging, especially for novice traders. Managing cash flow during the acquisition, renovation, and holding periods is crucial to ensure smooth operations.

Regulatory and Legal Considerations: Real estate trading involves compliance with all country’s or States various legal and regulatory requirements, including permits, licenses, zoning regulations, and tax obligations. Staying informed and seeking professional advice can help navigate potential legal pitfalls.

Conclusion:

Real estate trading presents a dynamic and potentially rewarding investment opportunity for individuals willing to engage in comprehensive market research, strategic planning, and risk management. By leveraging their knowledge of local markets, employing effective renovation strategies, and staying updated on industry trends, traders can harness the potential of real estate to generate substantial profits.

There Is More Money And Less Risk In Real Estate - Series 5: 10 Valuable Tips For Selling Real Estate

In the last series, it was emphasized that "you can employ low cost, medium cost or high-cost advertising strategies to achieve your goal. For instance, you can choose to carry out paid adverts online, pay for billboards (massively expensive), or do organic marketing, which costs you little or nothing. It all depends on your budget."

Now, here are the 10 valuable tips for selling real estate:

1. First, get your paperwork ready: This is self-explanatory. Once you decide to sell, make sure you get all the property documents in order to facilitate its sale. There's effective interest on the part of the buyer only when he cites the relevant documents for the property.

2. Hire a good agent or make use of the network of your fellow agents if you are an agent.

3. Following closely is the need to negotiate on asking price and fees. There's an absolute need for a written (contractual) agreement by the parties involved to guard against one being swindled.

4. Create virtual tours or shoot professional pictures or videos of the property for dissemination in online platforms.

5. List property in property magazines like castle or relevant sites such as Property Pro, Property 24.com. Radio and television advertising can also be used, or use outdoor marketing techniques such as putting up huge banners like PWAN Max property banners along the Lekki-Epe expressway in Lagos.

6. Leverage social media apps such as Facebook, Instagram, LinkedIn, and Twitter. For instance, there are over 33 million Nigerians on Facebook alone (a huge market) according to Google trend estimates. Moreover, the inbuilt business tool for engagements makes it a compelling favourite. For Twitter, it has the ability to go viral in mere hours, a huge attraction for the upscale market.

7. Run Geo-targeted adverts - This is a marketing technique that targets people in far place. This enjoys higher customer engagement and conversion rates than traditional marketing methods, according to research.

8. Create SEO optimized website - This is an invaluable strategy to drive traffic and convert more clientele to your website.

9. Put your solicitor on standby - In Nigeria, it is common practice to draw up documents without the aid of a lawyer. But my advice is to consult your lawyer before you close any property deal in order to have peace of mind. Their niche is legal documents, and they can easily find out if the papers are updated, legal, or not. You wouldn't want to lose a good opportunity to sell any property after spending so much time and money in closing down on an interested buyer just because another realtor is offering the same customer superior papers.

10. Carry out due diligence: This is particularly so for the agents and buyers. There is a need to investigate papers so as to ensure that they are genuine and not fall prey to fraudsters.

However, the success or failure of each marketing strategy is mostly about your budget and finding your own niche.

Stay tuned with us for more on this series. Subscribe to our Newsletter, and Follow us on social media for more series and updates. You can as well message our team on WhatsApp here.

There Is More Money And Less Risk In Real Estate - Series 4: Selling Real Estate in Nigeria

In spite of all the intricacies involved, the real estate sector remains one of the best, if not the best, in Nigeria. Little wonder lots of Nigerian and world’s billionaires made their money in the real estate sector. They include the likes of former U S president, Donald Trump; Chinese real estate giant, Wang Jianlin of the Dalian Wanda real estate group; the Managing Director of Shelter Afrique Nigeria, Femi Adewole; Paul Onwunaibe, the Chief Executive Officer for Landmark Africa; and Oludare Bello, Managing Director and Chief Executive Officer of Citec International Estate Limited.

Examining some of the intricacies and conventional practices in realty business reveals that there are various ways ownership of a piece of real estate can be transferred in Nigeria. Some of these include as a gift, through sale or assent; the most common method, however, is through sales.

Sale of property: This involves an outright transfer of ownership of a property (e.g., landed property) from one person to the other after money exchanged hands. It should be noted that sales or transfer of properties in Nigeria are guided by laws and certain ordinances of the land. Some of these include the Land Use Act of 1978; and in certain states like Lagos, we have the Land Registration Law of Lagos State 2015 and the Administration of Estate Law of Lagos State 2015.

Some conditions guiding the sale of property in Nigeria

There are certain conditions, such as law and other, that guide the legitimate sale of landed assets in Nigeria.

These include:

a) Sale of real estate often involves two major stages - the contract stage and the conveyancing stage.

b) When a property is sold, the relevant documentation transferring the title of the property and contract of sale stipulating terms of the transaction must be drafted and signed by both parties.

c) Once signing is done, the property must be perfected or registered. This means undergoing three main stages - governor's consent, stamping, and registration. More details are provided under Land Title and Documentation, in Chapter 6.

Note also that property may not be legitimately transferred where such property is under litigation. When you have a good and workable knowledge of the above, it can help you surmount avoidable hurdles in the transfer of property.

How to sell a piece of real estate

Marketing is a vital part of any enterprise. Knowing how to promote/market your property is crucial for sustainable positive outcomes in real estate business. Usually, the marketing approach is determined by the type of real estate and budget available for it.

In the real estate terrain, as in other areas, in today's world, the challenge is how to match the pressure brought on by technological advances and compete effectively. For instance, today, over 82% of sales people are marketing real estate in Nigeria through the internet, according to research.

So any seller that wants his/her brand out there needs to take cognizance of digital platforms and infuse sound digital marketing strategy in its marketing campaign, in line with the business goals, or expect little success or outright failure. Like Sun Tzu, the Chinese military general and strategist said, “Strategy without tactics is the slowest route to victory. Even as tactics without strategy is the noise before defeat."

Real estate marketing strategy

You can employ low-cost, medium cost, or high-cost advertising strategies to achieve your goal. For instance, you can choose to carry out paid adverts online, pay for billboards (massively expensive), or do organic marketing, which costs you little or nothing. It all depends on your budget.

If you desire to know more about the real estate industry and benefit from the enormous wealth therein, Subscribe to our Newsletter, and Follow us on social media for more series and updates. You can as well message our team on WhatsApp here.

There Is More Money And Less Risk In Real Estate - Series 3: Setting Up A Real Estate Business

If you’re a complete beginner in the real estate business, it is advisable that you attach yourself to a reputable and successful real estate company that has a very widespread. The enormous value of quality mentorship in any kind of venture can not be overemphasized.

The reason is that, you’ll have the opportunity to network and mingle with other well experienced and successful realtors through whom you can pick various selling tips. Such company would also have their offices and estates scattered across the nation, which gives you the opportunity to operate from any of their branch offices within your locality. Another good reason is that it is easier to market such brand’s products than a less known brand. They also provide you with free marketing resources and free estate inspection for both you and your client. You also get free high-packed training until you become a top-level seller. They have the most rewarding commission and incentive packages for each chain level of their consultants. The list goes on and on. Click here to join the PWAN GROUP top selling team and begin your training right away.

As a practicing Realtor, if you are planning to succeed in the properties business, it is important that you put a business plan firmly in place from the onset (contact our experts here if you need a standard business plan written for you). This simply means that you have to outline the resources you have and the goals you have for the future. It gives you a road map you can follow to achieve your business goals.

To set up your own company, a good business plan will stipulate the following steps:

1. Define your business – Define what your business is and your mission statement, which is a short description of what your business seeks to do. Also, when writing your business description, include details such as your business name, your business motto; location; contact details; legal structure, and names of business owners.

2. Carry out SWOT analysis - Do an analysis of your strengths, weaknesses, opportunities, and threats. Simply put, it is a list of what your business can do very well, the areas you have to work on, your opportunities, e.g., your ability to serve the undeserved population better, etc. and lastly, threats to your business.

3. Set goals - Set the long-term and short-term goals for your company.

4. Know your client - Identify who your ideal client is. It could be first-time home buyers, empty-nesters, or commercial real estate investors. This will help you develop a rock-hard business plan.

5. Strategize - Get down to a specific course of action, strategic for achieving the goals outlined.

6.Be time conscious - Set a time frame for each goal on your list to be achieved. A pursuit of time frame helps you to gauge your progress toward goal completion.

7. Write your executive summary - Lastly, you should define in broad terms what your goals are. It is called executive summary because it is the summary of everything else in the business plan.

At this juncture, it is important to state that there are several categories of real estate investors and/or entrepreneurs. At one time or the other, a realtor may be engaging in either sales or purchases of properties. If, for instance, you find yourself as the buyer, do well to recognize that real estate purchases follow basically five steps:

Step 1. Determine what you want to buy and if you can afford it.

Step 2. Secure the financing (through savings, loan, or grant)

Step 3. Follow up by making an offer.

Step 4. Inspecting the property

Step 5. Closing the deal by making payments and filling in the paperwork.

Note: Buy2Sell Offers (Real Estate Trading) do not necessarily require property inspection. Learn more.

If you are offering a property for sale, know also that even the seller of real estate products is also going to bear some cost. Such costs are associated with some necessary steps involved in selling any piece of real estate.

Below are the steps that outline the costs a property seller may have to bear, especially if the property in question is already being occupied.

a) You must state your asking price – To do this effectively, a property seller will have to compare his or her property with the price of other properties in the same neighbourhood over a period of six months or so. The easiest way to achieve that is through a comparative market analysis and then factor in the cost associated with other steps.

b) Decide to hire an agent or do the selling yourself – Hiring a professional estate agent will bring in expertise, better pricing, and quicker sales. But it will cost you more money because you will have to pay his/her commission.

c) Carry out repairs - To shore up the worth of your property, you have to budget for repairs of damages. You need to make repairs from licking roofs, damaged plumbing pipes, windows, doors, etc.

d) Carry out property improvement – Alternatively, you may embark on total improvement of the property being put up for sales. This process may gulp a handsome amount of money, but it will definitely attract a higher sale price.

e) Staging – In the event of staging an occupied property for sale, you will have to remove your furniture, and professionally remove decorations from the common rooms, living rooms, kitchens and master bedrooms, in a neutral way.

f) State your closing fee – Certain expenses incurred in the process of the transaction, such as legal fees, transfer fees, property taxes, and other incidentals, will be covered by the closing fees. The property seller should be prepared to shoulder at least 3% of the closing fee.

In summary, you do not need to break a bank or have a degree to start up your real estate journey as a realtor. As an investor, product and market knowledge is necessary for building your real estate investment portfolio. Stay tuned with us for more on this series. Subscribe to our Newsletter, and Follow us on social media for more series and updates. You can as well message our team on WhatsApp here.

There Is More Money And Less Risk In Real Estate - Series 2: Why You Should Join The Real Estate Business Train

A real estate business mogul Dr. Augustine Onwumere would always say: “If you are between the ages of 18 to 60 years and you are not doing real estate, you are shooting yourself in the feet.”

There are uncountable testimonies from the tremendous impacts of real estate business in the lives of both realtors, investors, and other practitioners. They all affirm that their exposure to real estate business is like their own allocation of an oil well.

Many were once jobless, poor, homeless and distressed all round until they stumbled into real estate business. The business changed their lives; and catapulted them to the realm of a millionaire/billionaire. The Founder of PWAN GROUP was once homeless but today owns one of the most successful real estate brands in Nigeria. And his company, PWAN GROUP is the first real estate marketing company in the world with over 500,000 consultants across the world. The company has over 40 subsidiary companies with more than 300 estates across Nigeria (both completely sold-out ones and currently selling ones) according to report from Channel TV.

If you are still wondering how real estate business turned a focused and hardworking pauper into a stupendous money-bag overnight, hear this; investment in land is the only asset that does not depreciate rather keeps appreciating.

Indeed, landed properties enjoy an all-time appreciation over and above stock market shares, government bonds and any other form of investments.

Because of its potency for excellent return on investment, many people invest in real estate. Another fact is, investment in real estate is a much less volatile investment than investing in the stock market or bonds; because real estate has real value.

Entry Points In Real Estate Business

Weather you are an investor or a realtor, there’s nothing stopping you from entering and succeeding in the real estate business. Your huge reserve running into millions and billions of naira should not be allowed to fritter down the drain or sink to infinitesimal jingling kobo. Of course, there is room enough to accommodate every person who can as much as speak up and has the drive to succeed in real estate business.

If you do not have the financial muscles to be a real estate investor, do not worry. There is ample chance for everyone who can do as little as spread information about available properties to play big in the property market. The most common determinant to becoming a real estate broker is the willingness and determination to sell against all odds. Unlike other professions, you must not have a degree or certificate to show that you’re a realtor. Neither do you need a base capital like a startup fund to start selling. In fact, in this digital age, you can choose to network and market remotely and close mega deals. There are countless evidences to prove that this strategy works 100%.

Indeed, many people who started with nothing have become multi-millionaires, just by being a realtor. As a real estate agent, all you need to do is connect property buyers to property sellers. That way, you earn fantastic commission each time you close a property deal. Click here to join a top selling team.

You can also provide other allied services such as construction, supplies of building materials, carpentry, bush clearing and sand-filling etc. Just locate your own pot of soup in the property sector and be committed to it.

Types of real estates

All over the world, there are basically five categories of real estate namely residential, commercial, industrial, special purpose and land.

Residential real estate - Any property which people call home comes under residential real estate. It can be a single-family home, duplexes, shared apartments, condos and town homes.

Commercial real estate - Commercial real estate applies to any property that is used for business or commercial purpose like retail stores, restaurants, office buildings, gas stations, hospitals and shopping centers.

Industrial real estate - Factories, power plants, warehouses, mines, oil fields, properties used to research, develop, manufacture, produce, store or distribute good and service, etc. are classified as industrial real estate.

Special purpose real estate – All real estate developments that are designated for public use are special purpose. They include government owned properties such as federal or municipal buildings, parks and public schools, it also includes houses of worship, stadium, cemeteries and other public spaces.

Land – Land covers a broad spectrum of real estate including vacant land, timber land or any land used for agricultural purposes such as farms, pastures, plantations, ranches or orchards. Vacant land may be considered either developed or undeveloped property.

In every country, however, real estate business is governed by, or practiced within the context of, a set of laws that operate in the respective regulatory environment.

Conclusion

Before getting down to this aspect of real estate and regulatory system in subsequent series, we’ll consider real estate as it is practiced in Nigeria. If you desire to know more about the real estate industry and benefit from the enormous wealth therein, Subscribe to our Newsletter, and Follow us on social media for more series and updates. You can as well message our team on WhatsApp here.

There Is More Money And Less Risk In Real Estate - Series 1: History of Real Estate Business

Introduction

The real estate industry is such a dynamic one that all other sectors of human existence seem to revolve around it. Everyone at one point or the other in their lives engages in real estate deals; be it house or land renting, leasing, purchase, sales or development, etc. This goes a long way to show the overreaching importance of this sector in the survival and growth of every state, corporate, and individual economy. To benefit from this fast growing and highly profitable industry, one needs to approach it with a good deal of product and industry knowledge. Anything other than that will be counterproductive.

With real life examples, there will be lots of information for those looking to launch into the industry newly and various high value lessons for those in need of better strategies to gain massive return on their investments or diversify their portfolios for high profits.

Definition of real estate

From the foregoing, it is clear that, beyond land or houses, real estate constitutes everything that improves the quality of a property and adds to the satisfaction of the property owner.

Thus, real estate can be defined as a real property with tangible assets. This absolutely includes land, houses built on the land, crops, road networks, and liquid and solid minerals underneath the property. It recognizes the right of the property owner to the land and its improvements. It also includes features of the land, like bodies of water, timber, or minerals, as part of real estate. Sometimes, a land owner may choose to retain the rights to these features even if the land is sold to someone else.

Invariably, the term real estate business can be defined as the business of buying, selling, renting, or investing in homes, land, or other real property.

Background of the contemporary real estate industry

The contemporary foundations of what has come to be known as estate management were laid in the mid-18th century. Then, a major re-organization took place in most of Europe in the wake of the Industrial Revolution. The consequence in the United Kingdom (UK), particularly, was massive shift of the population from the rural communities to the urban areas; and a redistribution of land rights and property interest followed.

Next, practitioners of different skills within the sphere of real estate management subsequently formed what was to become a professional body. At the beginning of the 19th century, a definite move to form a distinct professional group to embrace the various classifications was actualized.

London witnessed the most serious moves on June 27, 1843, and that gave birth to the Land Surveyors Club. The Surveyor Institution, which was established on March 23 1868, metamorphosed into the Royal Institution of Chartered Surveyors (RICS) in 1946.

The honour of being the pioneer of modern real estate business in Nigeria belongs to British expatriate named F.G. Gleave. Gleave was the first Chartered Surveyor to set up a general practice or estate surveying and valuation firm in Nigeria at about 1955. It all happened towards the fringe of the colonial era; and then there were few chartered surveyors in private and public employment in Nigeria.

Today, real estate is evolving at a tremendous pace in Nigeria. It has become a driving force of the nation’s economy. So much so that governments at all levels are more aware of the role of real estate development in the growth of their respective territories. All sectors of the economy, such as agriculture, power, tourism, telecommunications, etc., have come to terms with Nigeria’s real estate industry and are providing a veritable platform for the sector to thrive.

What’s more? Government agencies and private companies have put in place policies to facilitate staff home ownership housing schemes. Various employers have also realized that it is prudent to build their own estate to accommodate employees rather than pay ridiculous housing allowance for staff accommodation.

Conclusion

In light of the above, real estate companies and professional developers are flourishing. Thousands of Nigerians are currently generating wealth through their involvement in different spheres of real estate vocation. If you desire to know more about the real estate industry and benefit from the enormous wealth therein, subscribe to our newsletter and follow us on social media for more follow-up series and updates. You can also message our team on WhatsApp here.